The below article was written by Jim Dalrymple II on June 22, 2020 and was taken from Inman News: link here.

This is the first story in a multipart series on real estate and the summer market. Check back in the coming days for economic projections, predictions from industry leaders and analysis from members of the real estate community.

When the coronavirus pandemic first started shutting down the economy, some agents in Mariana Costa’s part of Massachusetts began to worry.

“There was a lot of fear about how they would continue to run their business,” Costa, a team leader with Keller Williams who works across Cape Cod and Boston, told Inman. “For a while there, everybody was trying to figure out, ‘What do I do.’”

But over the next few months, something remarkable happened: The market picked up. In fact, it picked way up.

“I normally have years between $15 million and $20 million with my team,” Costa said. “But we’re closing $12 million right now. What we’re normally doing in a year, we’re now doing in a month.”

Most recently, Costa closed a multimillion deal with multiple offers after the property had sat on the market with various other agents for nearly a decade.

Moreover the day she spoke to Inman, she closed a deal for a home in the half million dollar range for $65,000 over the asking price. The home had six offers the first weekend it was listed.

“This is not normal,” she added. “I’ve been practicing since 2005 and it’s the hottest it’s been.”

To the casual observer, Narravo’s experience may seem inexplicable. The coronavirus pandemic just shut down the economy for several months, left many millions of people without jobs and sent the stock market on a wild ride.

How could it be, then, that people are still flocking to real estate?

But numerous agents have in recent weeks recounted similar experiences. And coupled with the latest data, the picture that emerges is one in which U.S. real estate has fared relatively well despite broader economic turmoil. That doesn’t mean the country is out of the woods yet, but it does mean that the industry is now beginning the summer buying season on a positive, rather than calamitous, note.

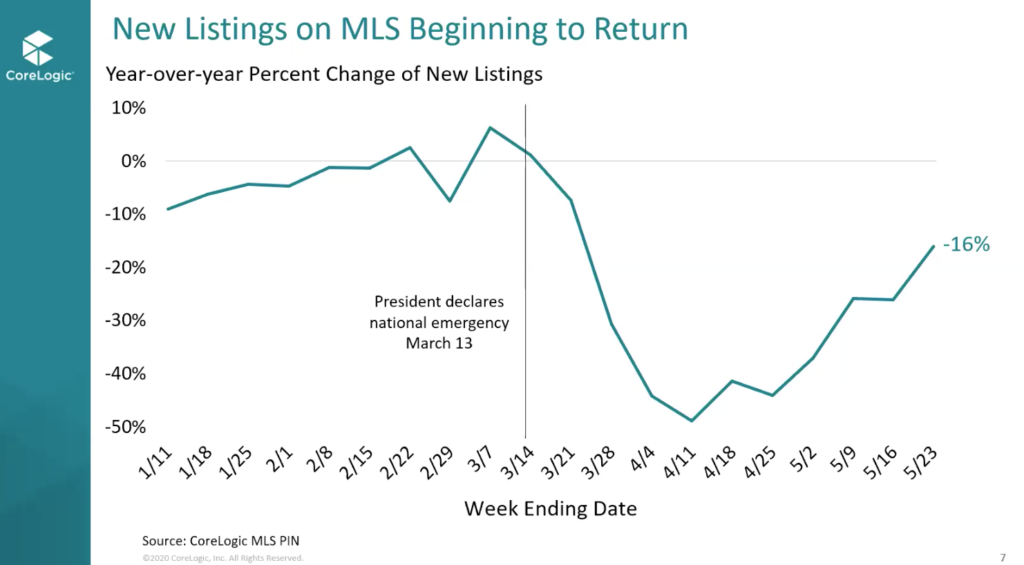

Though agents like Costa are currently experiencing a boom, those conditions were not a forgone conclusion at the pandemic’s outset. For example, CoreLogic found that as early as March the pandemic had “led to a sharp turnaround in consumer sentiment and housing activity across the country.”

“In the last two weeks of March, the number of new home purchase contracts signed declined 10 percent and 26 percent, respectively, compared to the same period last year,” CoreLogic reported.

That trend continued into April, with new listings continuing to fall according to data from realtor.com.

Zillow economist Skylar Olsen told Inman that after a robust beginning of the year, the number of pending sales ultimately bottomed out in mid April when they were down nearly 40 percent year-over-year.

Data from the National Association or Realtors (NAR) further confirms this trend.

This drop in activity is further born out by dozens of interviews Inman has conducted with real estate agents during the crisis, the vast majority of whom have described seeing a slower market in the early days of the outbreak. The point is to emphasize that like many other sectors of the economy, the pandemic did indeed have a significant impact on real estate.

That the real estate market suffered in the early days of the pandemic is probably not a surprise at this point. But what’s more intriguing is the extent of the market’s subsequent resilience.

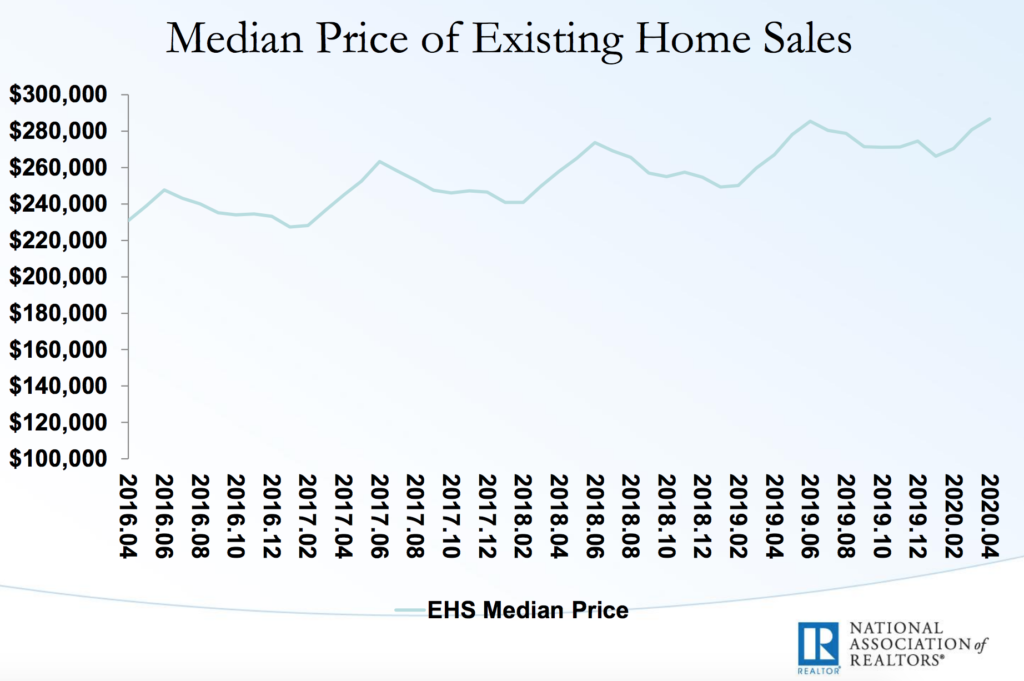

Probably the most notable example of that resilience right now is in home values.

NAR’s data shows, for instance, that even as sales numbers we’re falling in April, prices continued inching upward. Data from CoreLogic confirmed that trend, with the company saying that gains happened in every U.S. state in April.

Fast forward to last month and, according to a new report from Zillow, home values continued their upward trajectory and rose 4.3 percent year-over-year.

The report also notes that “the housing market has shown resilience during the coronavirus pandemic, slowing as stay-at-home orders were given across the country, but not screeching to a halt.”

Skyler Olsen | Photo credit: Zillow

Skyler Olsen | Photo credit: Zillow

Olsen explained to Inman that during the pandemic both buyers and sellers initially pulled back from the market. So, while there may have been less demand for housing at certain points, there was also less supply. And the resulting supply and demand balance worked to keep prices on an upward trajectory.

“A supply shock meets demand shock, and that stabilized prices,” she said.

A new report from realtor.com shows that price growth has continued into June, with year-over-year price gains of 4.6 percent as of the week ending June 13 and 4.3 percent as of June 6.

Prices also aren’t the only sign of some stability in the market. Among other things, Olsen told Inman that right now “sales are bouncing back” to the point that by mid June “we’re now beyond 2019 levels for our pending data.”

Javier Vivas, realtor.com’s director of economic research, also said in his company’s report that as “the market heads into the summer, growth in online home searches and asking prices has surpassed pre-COVID levels.”

CoreLogic’s chief economist Frank Nothaft has also characterized the market as “beginning to return” after taking a “big swing down” earlier in the pandemic. Nothaft made the comments during a video presentation early in June and, significantly, said his company’s data shows that new listings have been rebounding since their low point in early April.

Nothaft also confirmed Olsen’s analysis that pending sales are rising as well.

“That’s a real bright spot for the marketplace,” he added. “Buyers are out there. They’re coming back into the market as the shelter-in-place directives have been lifted.”

While the market is showing many signs of stability, everything hasn’t yet returned to normal. Among other things, while new listings are rebounding Olsen said that they still remain down about 20 percent year-over-year as of early June.

Zillow’s report further notes that “inventory is not growing at the rate typically seen during the springtime.”

That trend, too, appears to have continued into June: realtor.com reported that as of June 13 total listings in the U.S. were down 27 percent year-over-year. And time on market was 16 days slower. Vivas added in the report that “movement in supply and time on market remains well below seasonal pace.”

Realtor.com ranked the Denver, Boston and Seattle metro areas as the best for recovery among the top 50 markets in the U.S.. Charlotte, St. Louis and San Antonio have been experiencing the weakest recovery, according to realtor.com.

Moreover, despite overall price stability across the U.S. generally, some big cities such as Los Angeles, San Francisco, Pittsburgh and others actually saw decreases in May, according to Zillow’s data.

All of these data points represent sobering bits of news that show the real estate market continues to grapple with the impacts of the pandemic. And there are some indicators that those impacts could linger and influence home values, among other things, well into the future — though a subsequent part of the series will tackle forward-looking projections.

For the time being, however, it’s worth keeping in mind that many real estate market metrics are on an upward trajectory. Some stats may still be down, in other words, but as the summer begins they’re at least moving in the right general direction.

And given the broader economic crisis — unemployment remains very high, for example — it’s no surprise that most of the economic experts who spoke to Inman appeared to be cautiously optimistic about the market. Taylor Marr | Redfin

Taylor Marr | Redfin

Among them, Taylor Marr is a lead economist and data scientist at Redfin. He told Inman that so far the housing market has experienced a “relatively V-shaped recovery.”

Marr also said sellers have “noticed that competition is happening,” and that “touring activity has basically caught up with 2019 levels or even surpassed it a little bit.”

“Where we stand right now,” Marr added, “is we’re on the road to recovery.”